In today’s issue, I’m going to share the system I use to build an Ideal Customer Profile Matrix.

If you can duplicate this process, you will stop reaching out to random prospects, and your messaging will hit the right people.

Unfortunately, most SDRs rely on vague and subjective criteria when building their ICP, so they end up wasting time on the wrong prospects.

Without a well thought-out ICP matrix, a few challenges arise:

Challenge #1: You’re going after random companies: you follow subjective criteria and you end up talking to companies with different goals.

Challenge #2: You’re going after random people: you contact all kinds of job titles inside of these companies, and your messaging only resonates with a small number of prospects.

Challenge #3: You end up having meetings with the wrong people: when you manage to book meetings, they are with radically different people, who have very different goals.

You can overcome all of these challenges by building a better ICP matrix.

Here’s how I do it, step-by-step:

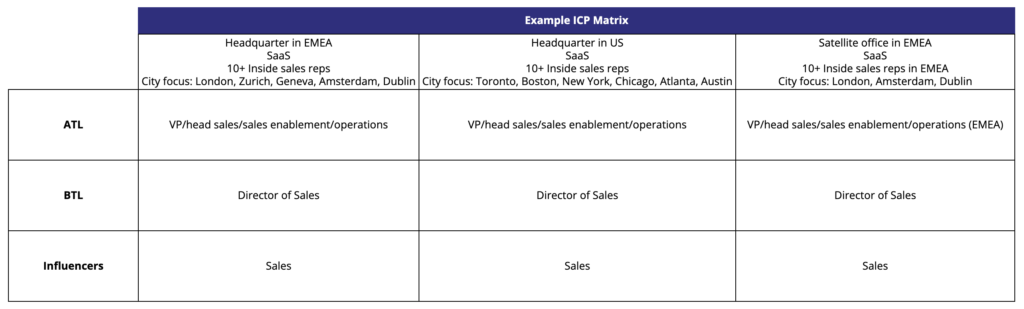

First, let’s look at my ICP matrix:

It’s composed of 3 columns where I define my ICCs (Ideal Customer Companies). Then we have rows where I define my ICTs (Ideal Customer Titles).

Let’s zoom in on the ICC.

I pick 3 different ICCs so I can test multiple types of companies and create various sequences based on these specific companies.

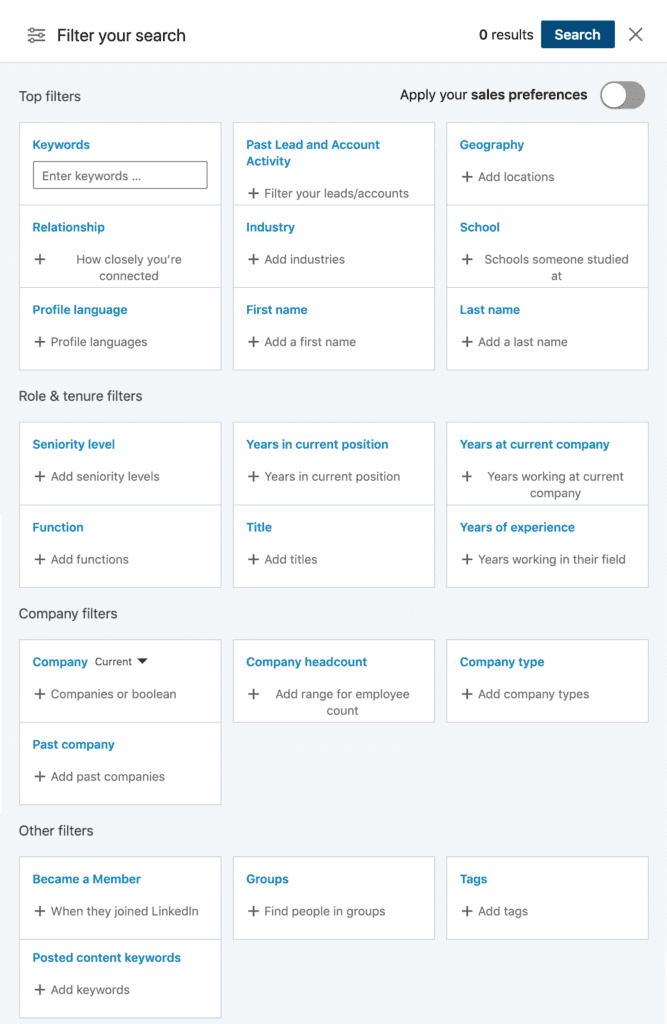

To define an ICC, you need to create a list of objective firmographic criteria. Typical criteria include revenues, funding type, headcount, industry, location, etc.

Subjective criteria should be avoided. For example, a “mission-driven company” isn’t an objective criteria. It would be hard to build a list based on this criteria, as the interpretation of mission-driven can be different from people to people.

I recommend using the filters available in LinkedIn Sales Navigator to make sure your list is objective.

Now that I have a few ICCs, I can focus on the ICTs. I use the ProActive Selling methodology to differentiate between 3 types of buyers.

The first type is Above The Line (ATL) buyers. ATLs are your typical fiscal buyers. They are often VP or C-Level, and they focus on:

risk

ROI

costs

The second type is Below The Line (BTL) buyers. BTLs are your user/technical buyers. Often Head of, Directors, Managers. They focus on:

how your solution works

how can it help getting them a promotion

how it saves them/their team’s time

The third type is optional. I call them influencers. These people are not actively involved in making a buying decision, but they can positively or negatively influence your deals.

For example, when you sell a solution that has to be integrated into a mobile app (called an SDK), you have to have a developer integrating it. In some cases, developers will refuse to integrate an SDK, even if the ATL and BTL have decided they would do it.

Finally, you need to make sure your matrix can help build an accurate lead list.

The most accurate way to test your ICP matrix is to share it with a colleague and to ask them to come back with a list of 10 – 20 leads. If the lead list fits with who you want to reach out to, then your ICP matrix is good.

If the list is all over the place, then your criteria aren’t objective enough. You will need to redo it until the list fits with your typical prospect.

And these are the 3 steps I follow to build my ICP matrix.

TL;DR:

Get my free, 4 min weekly newsletter. Used by 5.900+ salespeople to book more meetings and work when, where, and how they want.

Get my free, 4 min weekly newsletter. Used by 5.900+ salespeople to book more meetings and work when, where, and how they want.

I will never spam you, or sell your info.

Get each episode in your mailbox when they release. Grab special discounts and offers.